Suppose you went to a restaurant with your spouse, usually you order a particular favorite dish that you both like. But today your attention goes to an unknown dish in the menu card. You order it, and it turns out to be a little bad. Then everyone must have guessed it right that it would result in a heated argument that why you chose this dish and ruined our date?

But what if you have ordered the regular dish and somehow it was not having the usual taste, rather it tasted bad?

Then your spouse would not have blamed you. So the second option has no downside in this case. And the first one has little upside (there are chances of one of you or both of you like the dish) but huge downside of a heated argument.

But logically speaking, is the second option really that good?

Well it's certainly a safer one, but would you eat the same dish on every date? It will be boaring. But choosing something different each time just for the sake of trying to be different is also a bad strategy, because you will not be able to explore anything deeply, and everything will be just superficial.

What people do conventionally is try to choose the safer option, and what unconventional people do is analyse different options in front of them and choose wisely.

In the above case, if one finds a good dish, one may continue ordering it on every date till it feels good, but once it starts to become boaring, one can try a different one, till one finds another great dish to continue again.

It's that easy.

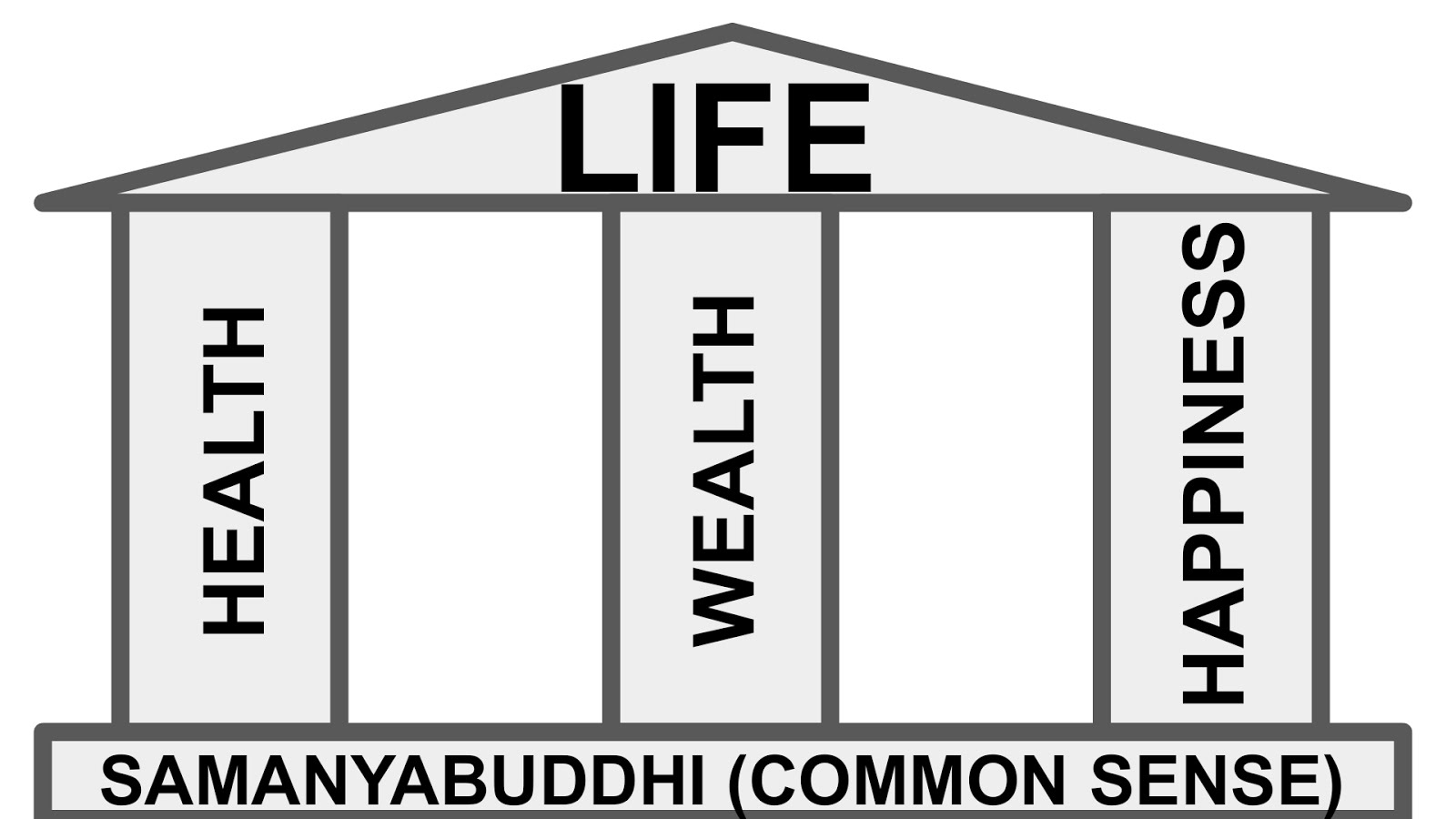

Now one can apply the same logic to other areas of life, instead of sticking to the conventional safer choice.

If one is not getting desired results then tweak the strategy, till one gets the desired results. Don't just keep blaming the luck. Try what is in your hands.

For example, if you are having huge loans and no savings, try decreasing your expenses, search for cheaper alternative, start saving more, try to increase your income, try creating passive income sources.

Not happy in your relationship with your spouse/girlfriend/boyfriend? Try searching what's going bad, Confront the obvious, don't delay an open talk, try listening more, don't be controlling, reconsider your thoughts, put yourself in the other person's shoes, say sorry if needed, put your ego aside, accept the reality, rather embrace the reality, prioritize what's important to you. It's not that hard. Rather continuing a bad relationship the way it is, is a hard thing to do.

Change is the only constant thing in the world.

The more one gets it, the more content one be.

The more one gets it, the more content one be.

This one thought have a great potential to make a difference.

Have a nice day..

Sumit,

The POWER is when,

You use ODDS,

To get EVEN.

The POWER is when,

You use ODDS,

To get EVEN.